Once a vendor has been set as a T4a recipient, the user can generate T4As when they are due. See CRAs ruling for when to report. T4As are generated for the year before the date set in Company Settings -> Payroll -> Employer -> Current Payroll Year.

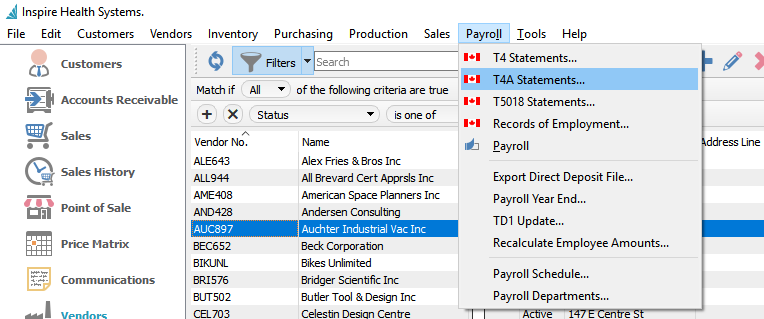

Go to the top menu “Payroll” and select T4A.

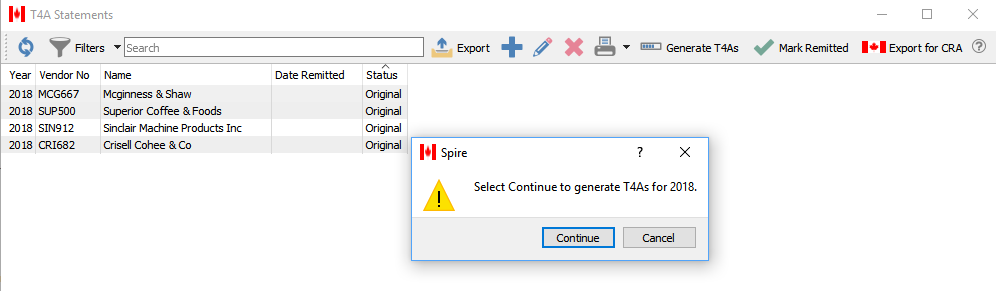

To add last years T4As for processing click the “Generate T4A” button.

Once the T4As are generated, they can be edited for corrections and additions. Spire enters the full amounts less HST/GST that were entered in accounts payable from the previous year. into box 48. All other boxes need to be filled in manually if required.

Check all fields for accuracy. Spire attempts to put the first and last names into the the correct boxes, but depending on how they were entered into the vendor, they may need correction.

Check for accuracy

Mark Remitted – If the T4A Statement has been remitted to CRA, clicking on the “Mark Remitted” will put a date stamp on the report. This will show the date under the column “Date Remitted”