General

Post to Accounts Payable – When enabled (recommended), receiving purchase orders will generate entries in Accounts Payable and General Ledger. The inventory receipts on POs will be accrued if received before obtaining the vendors invoice. Once the invoice is received, the AP entry is done from within the PO and the accrual is reversed. If the invoice is available on receipt of inventory, then the AP entry is posted without the accrual.

Include vendor freight in landed cost – If enabled, received purchase orders posts the Vendor Freight amount to the Accrued Freight account. If not enabled, then Vendor Freight is instead posted to the Freight Expense account defined in Company Settings -> Special Accounts when the vendor invoice is posted.

This option also affects Inventory Transfers that have Freight values. If enabled, the freight amount is posted to the Inventory control account, and if not enabled then the freight amount is posted to Freight expense account.

Allow over-receiving – If checked, then the user can receive more than what was ordered on a purchase order.

Warehouse/Purchasing Taxes

Sales Tax 1-4 – Set the default tax jurisdictions that get added to a warehouse when they are created.

Commercial Terms

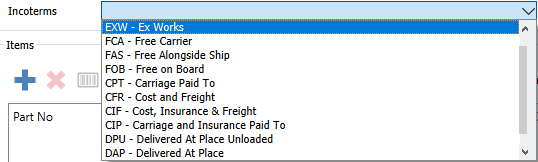

Use Incoterms – If selected, it will enable Incoterms on Purchase Orders, on the Main tab and within the General section.