A Surcharge such as ‘Shop Supplies’ or ‘Fuel Surcharge’ can be automatically calculated on the footer of Sales orders. The surcharge percentage is entered on Product Codes, which in turn are assigned to Inventory items. Adding items to sales orders will increment the total surcharge for each unit ordered. Surcharges can be defined as taxable in the Edit Sales Taxes configuration for any jurisdiction.

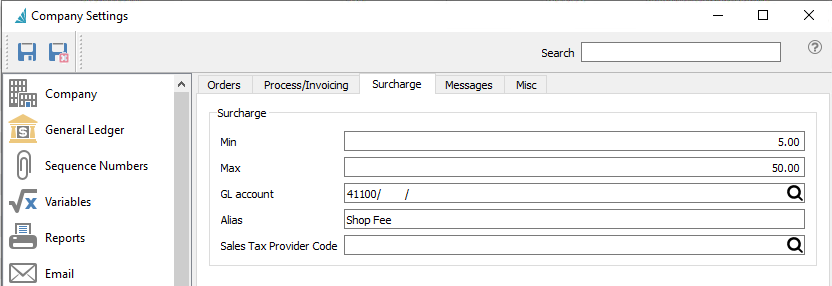

Min – Minimum amount to charge, if any items that support surcharges are on the sales order. If no items with surcharges are added, the total will be zero rather than the minimum amount.

Max – Maximum amount to charge on a sales order.

G/L account – The Ledger sales account that the surcharge amount is posted to.

Alias – The label for the surcharge that will appear on sales orders (ie – Shop Fees, Fuel Surcharge).

Sales Tax Provider Code – Reference to Avalara Sales Tax integration. See Integrations – Avalara Sales Tax in the manual for more details.